What is Extended Fraud Alert

If your identity has ever been stolen, then you know how frustrating and time consuming it can be to get it fixed. There are ways you can fix it long term, for instance, by placing a extended fraud alert on the account. …

What is Initial Fraud Alert

The next best thing to having a credit freeze is an initial fraud alert on your account. An initial fraud alert is good to have in cases where you don’t want to ever be a victim of identity fraud. This is a …

What Is Active Duty Military Alert

If you’re in the military and want to protect your credit while deployed, you should look into getting the Active Duty Military alert. It’s a feature that will protect your credit while deployed for up to one year. Here’s how it works, …

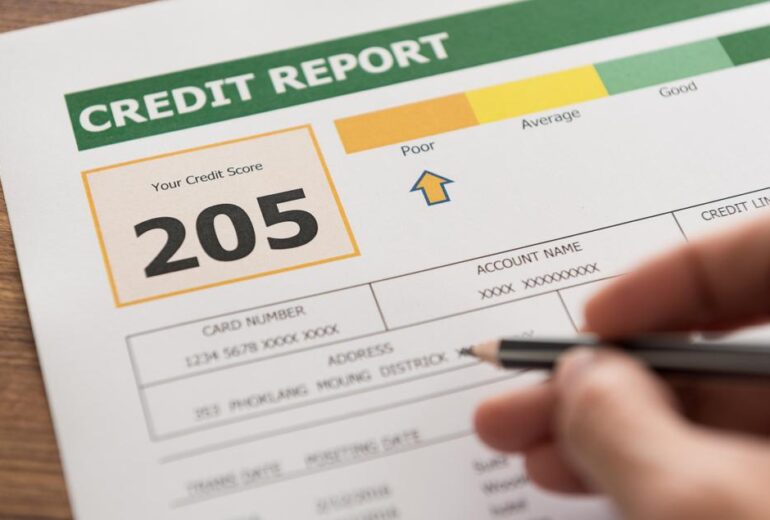

Improve a Credit Score in 30 Days: Part 1

If you want to raise your credit score in 30 days, the first step is to look for any errors on your report. If you find errors, correct them immediately. There could be record of late payments where there weren’t any late …

Improve Your Credit Score In 30 Days: Part 2

If you want to improve your credit score in as little as 30 days, one way to do that is by becoming an authorized user. See if you have family or friends with good credit who will help you with your struggling …

Improve Your Credit Score In 30 Days: Part 3

If you want to improve your credit score in as little as 30 days, one way to do that is to raise your available credit. Requesting a higher credit limit from an already-established creditor may help to boost your available credit line. …

Behavior That’ll Improve Credit Over Time

Although there are methods to improve a credit score fast, re-establishing a good credit score takes consistent behavior and time. Factors that influence a credit score include: • Credit payment history • Length of credit history • New credit accounts • New …

What To Look For On Your Credit Report

At least once a year, you should order your credit report from AnnualCreditReport.com. Once you get your report, make sure that you recognize the information on your credit report including the following: •name •addresses •Social Security Number •accounts •loans •If you find …

How Charge Offs Can Hurt Your Credit Score

A charge happens when you fail to make payments on a credit account for 120 days or longer. At this point, the creditor may mark the account as “charged off,” meaning they have written off your debt as a loss. It’s a negative …

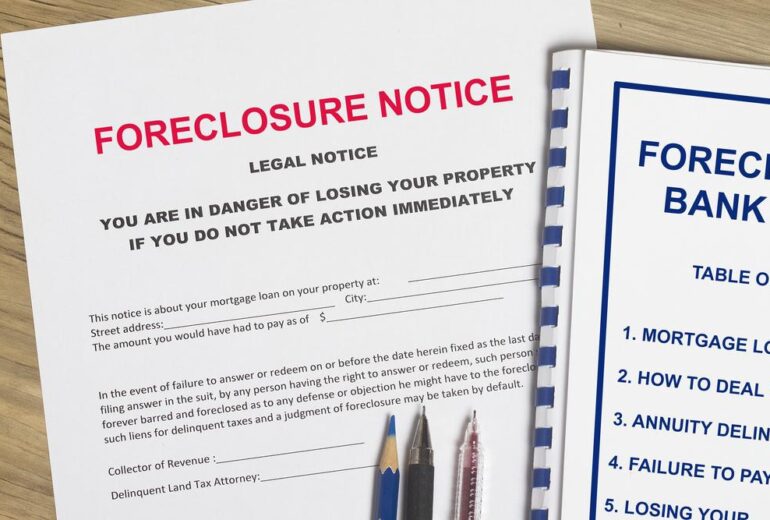

How Can a Repossession or Foreclosure Hurt Your Credit Report

Foreclosures and repossessions are serious delinquencies and will lower your credit scores considerably for up to 7 years. Lenders see this as…you signed a contract with them to buy a home or car and pay it in full over a period of …